How to Negotiate CRE Deals: Complete 2025 Guide

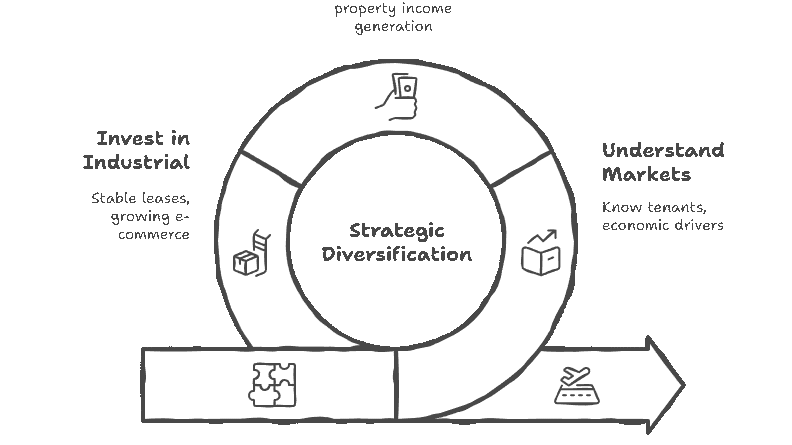

Commercial real estate negotiations separate successful investors from everyone else. One overlooked clause can cost millions. One smart concession can unlock a deal that seemed dead in the water. According to Realmo, understanding the fundamentals of CRE deal-making is what transforms average investors into top performers.

Read More