Building a CRE Portfolio That Actually Makes Money (Instead of Just Looking Impressive)

Look, I’m going to tell you something that might piss off some brokers – most commercial real estate portfolios are built backwards. People buy properties because they look good on paper, because their buddy made money on something similar, or because some guru told them industrial is “hot right now.”

I spent the first five years of my career watching supposedly smart investors build portfolios that looked diversified but performed like garbage. Beautiful spreadsheets, impressive property lists, terrible returns. They’d own an office building in Phoenix, a retail strip in Miami, and some warehouse in Dallas, thinking they were diversified. Really, they were just spread thin with no strategy.

The wake-up call came during the 2020 mess when I watched portfolios that looked bulletproof on paper completely fall apart. Meanwhile, this one client who owned four “boring” properties in secondary markets – all within driving distance of each other – barely felt the impact. His secret? He actually understood his markets and his tenants instead of just chasing the latest trends.

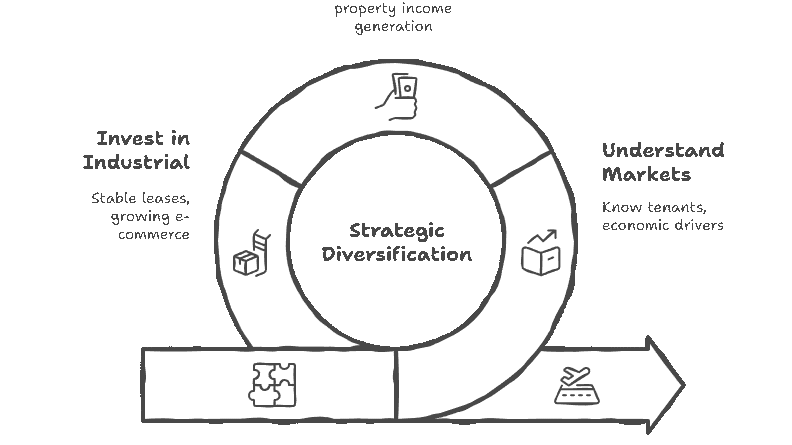

That’s when I figured out the difference between real diversification and what most people think diversification means. It’s not about owning different property types – it’s about understanding how different income streams respond to economic changes and building a portfolio that actually works together instead of just existing in the same LLC.

The Real Problem: Why Most CRE Portfolios Fail Before They Start

Here’s what kills me – people spend more time researching which Netflix show to watch than they do understanding how their properties actually make money. They’ll drop $2 million on a retail property because “retail is recession-proof” without understanding that their anchor tenant’s lease expires in 18 months and they’re already struggling.

I had this client who was so proud of his “diversified” portfolio. Office building in downtown Austin, shopping center in suburban Dallas, apartment complex in Houston. Looked great until you realized all three markets were tied to the same economic drivers. When energy prices tanked, all three properties got hit simultaneously. That’s not diversification – that’s correlation disguised as strategy.

The problem isn’t just geographic – it’s understanding how your properties actually generate cash flow and what can disrupt that. I see people buying “Class A office space” without realizing their biggest tenant is a startup burning through venture capital, or investing in retail properties anchored by businesses that Amazon can easily replace.

Real diversification means understanding the economic fundamentals behind each investment, not just spreading money across different property types and hoping for the best.

Property Types That Actually Work Together (Not Just Look Good on Paper)

After analyzing hundreds of successful portfolios, here’s what actually creates stability and growth:

Industrial: The Boring Workhorse Everyone Underestimates

I’ll be honest – industrial real estate isn’t sexy. Nobody’s impressed when you tell them you own a warehouse. But these properties have saved more portfolios than any other asset class I’ve seen.

The numbers don’t lie: industrial properties typically have 3-5 year leases, minimal tenant improvements required, and tenants who actually need the space for operations (they can’t just work from home). E-commerce growth means demand keeps increasing, and these properties are expensive for tenants to relocate from.

Real example: Client bought a 50,000 sq ft distribution center in suburban Phoenix for $3.2 million in 2019. Boring location, boring tenant (plumbing supply company), boring 5-year lease. That “boring” property has generated 12% annual returns and the tenant just renewed early because moving would cost them six months of downtime.

The key is location near transportation hubs and understanding your tenant’s business. A warehouse that makes sense for e-commerce fulfillment might be terrible for traditional manufacturing.

Multifamily: The Cash Flow Foundation

Here’s what most people get wrong about apartment buildings – they think it’s about location, location, location. It’s actually about understanding local job markets and demographic trends.

I’ve seen beautiful apartment complexes in “great” neighborhoods struggle because they were built for demographics that were already moving away. Meanwhile, this one client owns a modest 48-unit complex near a growing medical center that’s been 95%+ occupied for six years straight.

The secret is workforce housing – properties that serve people who have jobs but can’t afford luxury. Healthcare workers, teachers, municipal employees, skilled tradespeople. These tenants are stable, they need to live locally, and they’re not getting priced out by gentrification as quickly.

Avoid student housing unless you really understand that market. I’ve seen too many people get burned when universities change housing policies or enrollment drops.

Office: Choose Your Battles Carefully

Office real estate is where people make the biggest mistakes. They hear “remote work is killing office space” and either avoid it completely or think they’re getting deals on distressed properties.

The reality is more nuanced. Class A downtown towers? Yeah, those are struggling. But medical office buildings, government-leased space, and specialized facilities are doing fine. The key is understanding which businesses actually need physical space.

My best office investment is a boring 12,000 sq ft medical building anchored by a radiology practice. These guys can’t work from home – they need expensive equipment, patient parking, ADA compliance. They signed a 10-year lease with built-in rent escalations because moving would cost them $400,000+ in equipment relocation.

Avoid speculative office space and focus on tenants with operational requirements that tie them to physical locations.

Retail: It’s Not Dead, But It’s Definitely Different

Retail gets a bad rap, but the right retail properties in the right locations are printing money. The key is understanding which retail concepts are Amazon-proof.

Service-based retail is thriving – hair salons, auto repair, medical services, restaurants. I own a small strip center anchored by a physical therapy clinic, with a sandwich shop and a phone repair store. These businesses need foot traffic and local customers – can’t be replaced by online shopping.

Avoid big box retail and focus on neighborhood services. The pizza place, the dry cleaner, the urgent care clinic – these businesses serve local needs that can’t be fulfilled online.

Real numbers: that strip center generates 9.2% cash-on-cash returns and has had zero vacancy in four years. Not because it’s in a fancy location, but because the tenants serve real local needs.

Geographic Diversification That Actually Makes Sense

Here’s where most people screw up diversification – they think more cities equals better diversification. Wrong. It’s about understanding economic drivers and correlations.

Don’t spread yourself too thin geographically. I know investors who own properties in eight different states and spend more on travel and management than they make in additional returns. You can’t effectively manage what you can’t easily visit.

Focus on economic diversity within your geographic area. Better to own four properties in different suburbs of the same metro area with different economic drivers than to own properties in four different states that all depend on the same industry.

My most successful client owns six properties within a 45-minute drive of his house. Sounds boring, but he knows every submarket, every major employer, every development project. When a major company announces layoffs, he knows which properties will be affected. When a new highway gets approved, he knows which areas will benefit.

Understand economic correlations. Austin, Dallas, and Houston might be different cities, but they’re all tied to energy and technology. If those sectors struggle, all three markets feel it. Better to own properties in markets with truly different economic foundations.

I learned this lesson watching portfolios get hammered in 2008 because people thought Phoenix, Las Vegas, and Miami were “diversified” when they were all dependent on construction and tourism.

The Financial Structure That Actually Works

This is where the real money gets made or lost – how you finance and structure your portfolio.

Debt diversification matters as much as property diversification. Don’t get all your loans from the same bank or tie everything to the same interest rate structure. I’ve seen great portfolios get destroyed when banks got nervous and called in multiple loans simultaneously.

Stagger your lease expirations. Never have more than 30% of your rental income up for renewal in the same year. Plan this from day one – it’s harder to fix later.

Real example: Client bought three properties with major leases expiring in 2024, 2026, and 2028. When 2024 came around and his tenant wanted to renegotiate lower rent, he had stable income from the other two properties to negotiate from a position of strength.

Keep powder dry. Maintain access to capital for opportunities. The best deals happen when other people are stressed – you need to be able to move quickly.

I structure deals so clients can access 70-80% of their equity through credit lines without selling properties. When good opportunities arise, they can act fast instead of spending six months trying to get financing.

Red Flags I See in Bad Portfolios

After reviewing hundreds of portfolios, here are the patterns that predict trouble:

All properties requiring active management. If every property needs constant attention, you’re not building wealth – you’re creating a full-time job with unlimited liability.

Chasing yield without understanding risk. That 12% cap rate property in a declining market isn’t a deal – it’s a value trap. High returns usually mean high risk, and if you can’t identify the risk, you shouldn’t take the returns.

No exit strategy. Every property should have a clear path to exit profitably. If your only exit strategy is “hold forever,” you don’t have a strategy.

Overleveraging during good times. I see this constantly – people use cheap money to acquire everything they can, then get crushed when rates change or income drops. Conservative leverage saves portfolios during downturns.

Ignoring market cycles. Every market goes through cycles. If your entire strategy depends on current conditions continuing forever, you’re setting yourself up for failure.

Building Your Portfolio the Right Way

Here’s how I actually build portfolios that work long-term:

Start with one property and understand it completely. Master the fundamentals before you diversify. I’d rather see someone own one property they completely understand than five they’re confused about.

Focus on cash flow first, appreciation second. Properties that generate positive cash flow from day one give you options. Properties that depend on appreciation for returns give you stress.

Build relationships before you need them. The best deals come from relationships – brokers who call you first, lenders who understand your strategy, property managers who actually manage.

Learn one market deeply before expanding. Become the expert in your backyard before you start looking at other cities. I know investors who understand their local market better than most brokers and consistently find opportunities others miss.

Plan for problems. Every property will have issues. Plan for 6-12 months of vacancy, major maintenance needs, and economic downturns. If your projections don’t work with these assumptions, find different properties.

The Team That Makes It Work

This isn’t a solo game. The investors who consistently succeed have teams that help them make better decisions and avoid expensive mistakes.

Find a property manager who thinks like an owner. The difference between good and bad property management is often the difference between profit and loss. Pay for quality management – it’s not an expense, it’s an investment.

Build relationships with local brokers. The best deals never hit the market publicly. They go to investors who brokers know, trust, and want to work with.

Get legal and tax advice from CRE specialists. General practice attorneys and accountants often miss opportunities and create problems in commercial deals. Pay for expertise.

Find a lender who understands your strategy. Banking relationships matter in commercial real estate. Cultivate relationships before you need them.

I spend about 20% of my time maintaining relationships with the people who help my clients succeed. It’s not glamorous, but it’s what separates successful investors from everyone else.

The Bottom Line: Building Wealth vs. Building Headaches

Here’s what I wish someone had told me fifteen years ago: a great portfolio isn’t impressive – it’s profitable and stress-free.

The best portfolios I see aren’t the ones with the most properties or the highest total value. They’re the ones that generate consistent cash flow, require minimal drama, and give owners flexibility to live their lives.

Start small, understand your markets, build real relationships, and focus on fundamentals over trends. Every successful CRE investor I know followed this path. Every failed one tried to shortcut it.

Your goal isn’t to own the most properties – it’s to build a system that generates wealth without dominating your life. Do that right, and you’ll have something that lasts decades instead of just looking good in your first quarterly report.

The commercial real estate market will give you every opportunity to make bad decisions quickly. The key is making good decisions consistently, even when they’re boring. Especially when they’re boring.